A Helpful Guide to Paying Your Property Taxes and Applying for BC's Home Owner Grant

Yes, it’s that time again….heading into summer and paying our property taxes. You’ve probably just received your tax notice in the mail and I thought I would explain the different ways to pay and how to register for your Home Owners Grant (HOG), which is slightly different this year.

Home Owner's Grant

The home owner's grant reduces the amount of property tax you pay for your principal residence. If your property is your principle residence and is assessed at $1,625,000 or less, you will receive the full regular grant amount of $570. Properties assessed over that amount may receive a partial grant (click here to learn about grant thresholds). The fastest and easiest way to apply for your home owner grant is online, but you can also apply by phone using our automated self-serve system or with the help of an agent.

Applying Online:

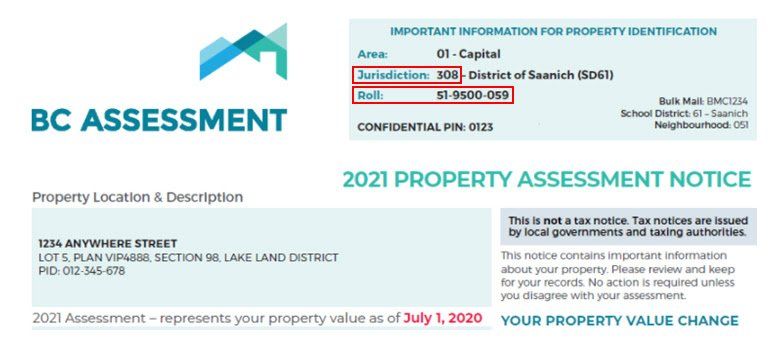

To get started, you’ll need the jurisdiction and roll number for the property you are applying for. These numbers can be found on any of the following:

- Your property tax notice

- Your BC Assessment notice you received in January (see image below)

- A search through BC Assessment

Applying by Phone:

There are two ways to apply over the phone; you can apply by phone anytime using the automated self-serve system by calling or you can apply with help from an agent from Monday to Friday, 8:30 am to 5:00 pm

1-888-355-2700

Paying Your Property Taxes

There are three ways you can pay your property taxes:

1. Perhaps you have been paying them with your mortgage payment and then the lender will remit the payment directly. Your tax payment can change through-out your term as taxes do change and the lender wants to make sure you have enough in the tax account. If you ever want to know how much you have in your tax account call your lender and they will be able to give you the number. If you have a high ratio mortgage most lenders require the taxes be added onto the mortgage payment. If you need help figuring this out or finding your lender’s phone number, call me!

2. Write a cheque for the due date and pay July 2nd, 2021 at the city or pay online via most chartered banks and credit unions.

3. Pay the city monthly on a preauthorized debit right from your bank account. (If this was not previously set up you would be setting it up now for your 2021 payment.)

P.S. It’s my intention to continue building lifelong relationships one client at a time and remain your personal mortgage consultant. If you know of a friend, co-worker or family member who needs a mortgage, be sure to contact me. Your personal referrals are the greatest compliment I can receive.